Local governments play a key role in achieving the Sustainable Development Goals through the delivery of public services. Yet, few systematic indicators exist to determine how effective local public sector spending is on a country’s development (i.e. economic growth, poverty reduction, improvement of infrastructure and services). The Local Public Sector Initiative (LPSI) is attempting to solve this problem through developing a set of measures to analyze and compare dimensions of local public sectors around the world.

LPSI metrics measure varying aspects of the institutions and finances that comprise the Local Public Sector (LPS). LPS is understood to be “part of the public sector that regularly interacts with residents, civil society, and the private sector within a localized setting”. The metrics used to profile the LPS are a combination of qualitative and quantitative measures related to government structures, allocation of responsibility, and financial records that can be compared across countries.

LPSI offers a template for persons interested in creating a country LPS profile. The template is accompanied by an easy-to-follow guide for filling out and interpreting public sector information in Excel.

LPSI offers a template for persons interested in creating a country LPS profile. The template is accompanied by an easy-to-follow guide for filling out and interpreting public sector information in Excel.

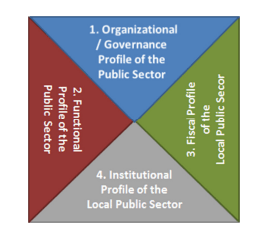

By evaluating four distinct metrics, we can gain insight into the how accessible public services are to local residents, and how development is impacted as a result.

Organizational/Governance Structure

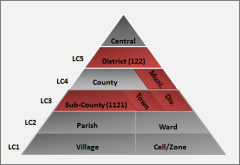

An understanding of governmental hierarchy, especially below the national level, can reveal how the public sector is structured. This structure may indicate a relationship between coordination of governance levels and delivery of public services. For example, larger jurisdictions may have larger economies of scale, while smaller jurisdictions allow residents more voice.

Organization refers to the structure of authority below the central (federal) level. Organization is measured by the number of administrative tiers/levels that exist, and the jurisdiction of each level. If jurisdiction falls within a high-level tier, as well as a sub-administrative tier, this information should be recorded for comparison.

exist, and the jurisdiction of each level. If jurisdiction falls within a high-level tier, as well as a sub-administrative tier, this information should be recorded for comparison.

Governance refers to function, legal status, and budgetary responsibilities. These dimensions are measured by the types, features, functions, and governance of each tier, such as administrative hierarchy, existence of elections, and functional profile.

For more information on measuring the Organizational/Governance Structure of the local public sector, please visit http://www.localpublicsector.org/docs/LPSCP_Handbook.pdf

Functional Responsibilities

Function refers to the responsibilities of each level of the LPS. The focus of this metric is to determine which governance or administrative tiers are responsible for delivering certain public services.

Using the the Classification of Functions of Governments developed by the IMF, functional responsibilities are measured by reporting the services each tier is expected to deliver. It is also important to note if multiple levels/tiers share responsibility to perform a function or deliver a service.

Using the the Classification of Functions of Governments developed by the IMF, functional responsibilities are measured by reporting the services each tier is expected to deliver. It is also important to note if multiple levels/tiers share responsibility to perform a function or deliver a service.

For more information on measuring the Functional Responsibilities of the local public sector, please visit http://www.localpublicsector.org/docs/LPSCP_Handbook.pdf

Fiscal Profile

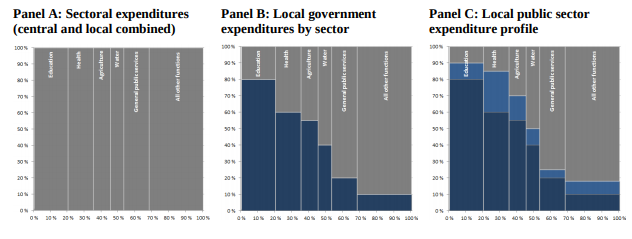

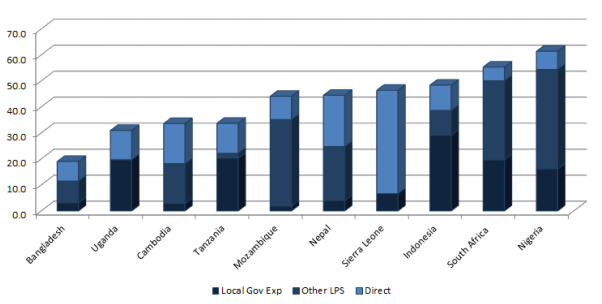

Comparing governance level revenues, intergovernmental transfers, and borrowing to LPS expenditures provides a better understanding of how effective public services are on economic growth.

To form a clear image of a country’s public sector finances, we want to compare local expenditures and revenues. Public financial information on the national, state, and local government can be found in the IMF Government Finance Statistics (GFS) Yearbook, but this data exists for very few developing countries. The tiers or levels of local government often report their finances, as well, and are sometimes found in the national budget reported by the state or country.

LPSI considers four types of community-level expenditures:

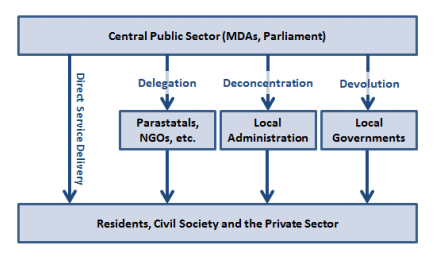

Central expenditures are funds and services provided to local communities by the federal government directly. Using IMF financial statistics and national budget documents, we can measure the amount of money spent by the central government on each sector (i.e., Health, Education, Agriculture, Sanitations, etc.). Economic classification of funds are also used to measure these expenditures, including payrolls, interest, subsidies, and grants.

Devolved expenditures are funds and services provided by local governments. Devolution, also known as decentralization, is defined as, “the transfer of authority for decision-making, finance, and management to quasi-autonomous units of local government with corporate status.” Thus, local governments are given responsibility for  providing certain public services to residents. Financial information regarding local government expenditure is reported by the IMF GFS Yearbook, and by local governments directly.

providing certain public services to residents. Financial information regarding local government expenditure is reported by the IMF GFS Yearbook, and by local governments directly.

Deconcentrated expenditures are the expenses of deconcentrated entities. These entities are a hierarchical part of a higher-level administrative tier or governance level. Often considered a weak form of decentralization, deconcentrated entities do not have political leadership, but are able to shift responsibilities from officials in the capital city to local districts or provinces. Deconcentrated entities are formal entities within the national budget, and therefore financial information for deconcentrated expenditures are easy to extract.

Delegated/Direct expenditures come from entities that exist outside the public sector, but work closely with local residents to deliver public services. These entities are often parastatal organizations, non-governmental organizations (NGOs), or outsourced entities from the private sector. The central government delegates responsibility to these entities to provide certain services. The only expenditures considered to be delegated/direct are those from localized government services delivered through close interaction between the public sector and citizens.

In creating a fiscal profile, LPSI also considers revenues, intergovernmental transfers, and borrowing across governance levels or administrative tiers in the public sector. This information reveals how LPS spending is financed, and can inform us about the efficiency and accountability of the LPS in question.

Revenue consists of local, or own source, taxes, social contributions, grants, and miscellaneous non-tax monetary sources.

Intergovernmental Transfers can be general or conditional. General-purpose transfers are not targeted, whereas conditional transfer are targeted. Examples of conditional transfers include recurrent transfers (i.e. wage grants) and capital transfers (i.e. capital grants).

Borrowing is an important indicator of local government finance capability. Net lending/borrowing records allow us to measure the net result of transactions.

Revenue, intergovernmental transfer, and borrowing information is most commonly found in national budget documents, documents from local government ministries, and other documents reporting LPS finances.

For more information on measuring the Fiscal Profile of the local public sector, please visit http://www.localpublicsector.org/docs/LPSCP_Handbook.pdf

Institutional Profile

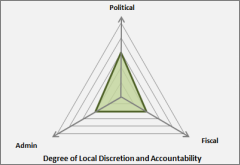

The local public sector’s arrangement is important in assessing institutional and intergovernmental relationships between subnational levels. Autonomy in these areas can affect a government’s ability to adapt to local needs. Poor arrangements can also lead to corruption and misuse of local resources.

Political arrangement is used to evaluate political decentralization in the LPS. Because decentralization brings decision-making capabilities directly to the people, it is a central part of delivering public services. Political arrangements in the public sector are documented through the types of power structures, the structure and quality of local electoral systems, the nature of political party systems, and the local participation and accountability at each governance level or administrative tier.

Administrative arrangement is imperative in the actual deliverance of public goods. However, the ability of local governments to respond to public needs is reliant on a government’s administrative autonomy and power. The effectiveness of administrative arrangements in the LPS is measured by the amount of authority a local government has over local financial management, procurement, human resource administration, and public service delivery at each level.

Administrative arrangement is imperative in the actual deliverance of public goods. However, the ability of local governments to respond to public needs is reliant on a government’s administrative autonomy and power. The effectiveness of administrative arrangements in the LPS is measured by the amount of authority a local government has over local financial management, procurement, human resource administration, and public service delivery at each level.

Fiscal arrangement is defined by LPSI as “the assignment of revenue sources; the provision of intergovernmental fiscal transfers; and the institutional framework surrounding subnational borrowing and debt.” Assignment of revenue sources is measured the degree of local control over the tax rate and base. The design of intergovernmental fiscal transfers includes the formula allocation of resources, as well as timeliness and completeness. Subnational borrowing of a LPS is measured by the authority and autonomy of a government to borrow money.

For more information on measuring the Institutional Profile of the local public sector, please visit http://www.localpublicsector.org/docs/LPSCP_Handbook.pdf

Future Implications

Expanding local public sectors brings decisions and finances closer to the people, effectively encouraging empowerment, individual ownership, and improved economies. Moving forward, the LPSI metrics offer a systematic way of evaluating local public sectors. This methodology makes it possible to identify which local communities effectively receive public services, and which do not. In turn, we can learn from these observations and promote community-led development that improves access to local public services.

Photos courtesy of The Local Public Sector Initiative

Featured Image Courtesy of the Asian Development Bank